How to Become Chartered Accountant

Chartered Accountancy has become one of the most promising professions in India. There were times when the word Chartered Accountant was synonymous with the term book-keeper and the realm of Chartered Accountant was confined to Accounts, Audit and Taxation. Presently there is no field, whether it is Business Finance, Management, Risk Management, Business Planning, Information System Audit or Environment Audit so on and so forth, where Chartered Accountants have not carved a niche for themselves. In fact, with greater synthesis of the world economy, the role of Chartered Accountants has changed to complete business solutions provider providing qualified CAs a fulfilling career throughout their life.

Requirements to become a Chartered Accountant

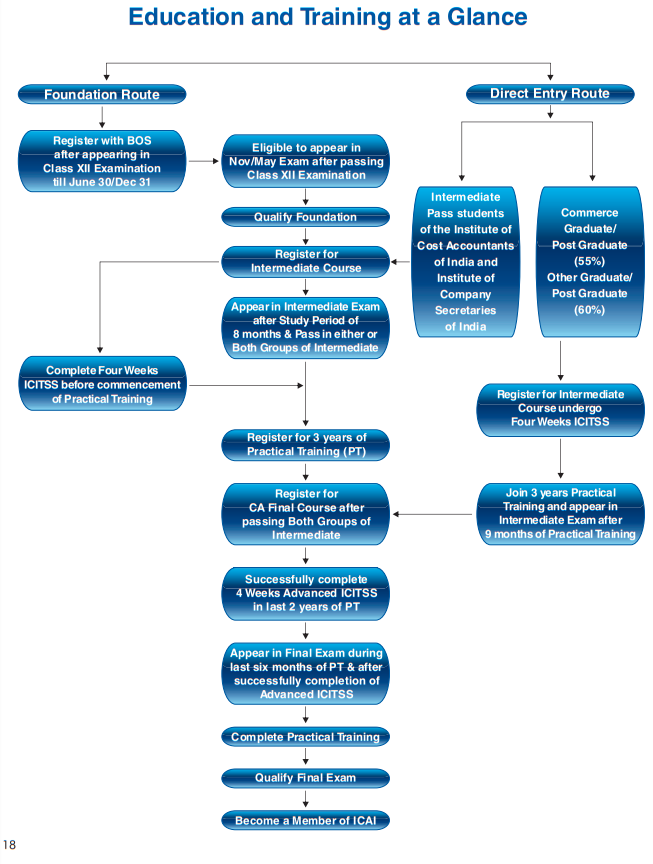

1. Through Foundation Course route:

(i) Enrol for Foundation Course after appearing in Class 12th Examination conducted by an examining body constituted by law in India or an examination recognized by the Central Government as equivalent thereto. (ii) Complete four months Study Period. Register till 30th June/ 31st December for being eligible to appear in November/ May Foundation Course Examination.(ii) Appear in Foundation Examination after passing in the Senior Secondary Examination (10+2 examination) conducted by an examining body constituted by law in India or an examination recognised by the Central Government as equivalent thereto and on complying with (ii) above.(iii) Join Intermediate Course after passing Foundation Examination.(iv) Undergo Four Weeks Integrated Course on Information Technology and Soft skills (ICITSS) consisting of Courses on Information Technology and Orientation Course at the earliest but these are to be completed compulsorilybefore commencement of their articleship.(v) Appear in Intermediate Examination on completion of 8months of study course as on first day of the month in which theexamination is to be held.(vi) Join articled training after passing either of the Group or Both Groups ofIntermediate Course and after successfully undergoing ICITSS.(vii) Clear the balance Group (if any) of Intermediate Examination.(viii) Register for Final Course.(ix) Successfully undergo Four Weeks Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical trainingbut before appearing in the Final Examination.(x) Appear in the Final Examination on completion of the practical training or whileserving last 6 months of articled training on or before the last day of the month preceding the month in which the examination is to be heldafter successful completion of AICITSS. (xi) Complete articled training of 3 years. (xii) Pass Final Examination. (xiii) Enrol as a member of the ICAI and be designated as “Chartered Accountant”.

2. Through Direct Entry route:

I. Commerce Graduates/Post-Graduates (55%) or Other Graduates/Post-Graduates (60%):

(i) Enrol with the Institute for Intermediate Course.(ii) Undergo Four Weeks Integrated Course on Information Technology and Soft skills (ICITSS) consisting of Courses on Information Technology and Orientation Course before commencement of their articleship.(iii) Register for Practical Training of three years.(iv) Appear in Intermediate Examination on completion of 9 months of Practical Training on first day of the month in which the examination is to be held.(v)Appear and pass in both groups of Intermediate Examination.(vi) Register for CA Final Course.(vii) Successfully undergo Four Weeks Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical training but before appearing in the Final Examination.(viii) Appear in the Final Examination on completion of the practical training or while serving last 6 months of articled training on or before the last day of the month preceding the month in which the examination is to be held after successful completion of AICITSS.(ix) Complete articled training of 3 years.(x) Pass Final Examination.(xi) Enrol as a member of the ICAI and be designated as “Chartered Accountant”.

Provisional Registration: Candidates who are pursuing the Final year of Graduation Course shall be eligible for provisional registration to the Intermediate Course. Such candidates would be required to submit satisfactory proof of having passed the graduation examination with the specified percentage of marks within such period not exceeding six months as from the date of appearance in the final year graduation examination. During the period of provisional registration, the candidate can undergo and complete ICITSS. It is clarified that in their case, the practical training will commence only on becoming a graduate with specified percentage of marks. Such candidates shall be eligible for appearing in the Intermediate Examination on completion of nine months of practical training. If such candidates fail to produce the proof within the aforesaid period, his provisional registration shall be cancelled and the registration fee or the tuition fee, as the case may be, paid by him shall not be refunded and no credit shall be given for the theoretical education undergone. II. Candidates who have passed Intermediate level examination of Institute of Company Secretaries of India or Institute of Cost Accountants of India

(i) Enrol with the Institute for Intermediate Course.(ii) Undergo Four Weeks Integrated Course on Information Technology and Soft skills (ICITSS) consisting of Courses on Information Technology and Orientation Course at the earliest but these are to be completed compulsorily before commencement of their articleship.(iii) Appear in Intermediate Examination on completion of 8 months of study course as on first day of the month in which the examination is to be held.(iv) Join articled training after passing either of the Group or Both Groups of Intermediate Course and after successfully undergoing ICITSS.(v) Clear the balance Group (if any) of Intermediate Examination.(vi) Register for Final Course.(vii) Successfully undergo Four Weeks Advanced Integrated Course on Information Technology and Soft skills (AICITSS) consisting of Courses on Advanced Information Technology and Management Communication Skills during the last two years of practical training but before appearing in the Final Examination.(viii) Appear in the Final Examination on completion of the practical training or while serving last 6 months of articled training on or before the last day of the month preceding the month in which the examination is to be held after successful completion of AICITSS.(ix) Complete articled training of 3 years.(x) Pass Final Examination.(xi) Enrol as a member of the ICAI and be designated as “Chartered Accountant”.

Stipend during Practical Training

Click Here to Check Stipend Details

Thanks